- November 5, 2022

- Posted by: Legend Consultancy

- Categories:

The Shipbuilding Industry in Turkey

Summary This report on the shipbuilding industry in Turkey is one of a series studies covering various OECD countries and non-OECD economies, and has been prepared to inform OECD’s Council Working Party on Shipbuilding (WP6) on the status and future prospects of that industry. This report is the first to cover an OECD member country. The report benefited from extensive comments from the Delegation of Turkey but the views expressed in the report are those of the OECD Secretariat, and do not necessarily reflect the views of the Government of Turkey.

THE SHIPBUILDING INDUSTRY IN TURKEY INTRODUCTION

1. Shipbuilding in Turkey has evolved from an old traditional activity in Anatolia to an internationally recognised industry, especially since the early 1990s. The industry has modern, quality certified shipyards that can build ships, yachts, mega-yachts, and sailing boats, as well as carrying out extensive repair and conversion works. Turkey’s shipyards are mainly located in the Marmara Region, namely Tuzla, Yalova, and İzmit, which have developed into dynamic shipbuilding centers. Also, in recent years the emerging Black Sea and Mediterranean Regions have increasingly attracted shipyard investments.

2. Turkish shipyards have a tradition spanning eight centuries. At the time of the Ottoman Empire, shipyards were able to build large, powerful naval vessels, and yards continued their modernization following the foundation of the Republic of Turkey. After 1983, yards began to move from Haliç İstanbul (Golden Horn) to the Tuzla Shipyards Region. Having started to operate in this region, Turkish shipyards struggled to complete their infrastructure investments to comply with advancing shipbuilding technology and so initially performed shipbuilding and repair works simultaneously.

3. In the last decade, in parallel with developments in the global market, Turkish shipbuilding experienced a several-fold increase in its shipbuilding and export capacity, including a significant product diversification. According to order books, this resulted in Turkey being regularly placed in the top ten countries on the basis of its deadweight (dwt) production, and in the top five countries by the number of ships.

4. In recent years Turkey has increasingly tapped into niche markets, which in turn has led to a growing participation by Turkish shipyards in the international trade in new ships. In parallel, there has also been strong growth in the marine equipment manufacturing sector, which could increasingly also tap the export market. These developments reflect in part the strategic location of the yards, the experienced workforce, the quality of production and Turkey’s significant role as a political, cultural and economic bridge between Europe and Central Asian and Middle Eastern economies. SNAPSHOT OF THE TURKISH SHIPBUILDING INDUSTRY

5. The shipbuilding and repair industry is considered to be one of the most promising industrial sectors in Turkey, and there have been significant developments in recent years. At present, there are 70 active shipyards in Turkey, while another 56 (most of which might be described as a medium size) are reported to be in the process of being built, although this number may be affected by the reduced demand for shipbuilding following the 2008 world economic slowdown. The economic slowdown also affected exports, which peaked at USD 2.7 billion in 2008, but had declined to just over USD 1 billion in 2010 (Undersecretariat for Maritime Affairs-UMA, 2011).

6. While Turkish yards have traditionally specialized in yachts and smaller commercial vessels, in recent years they have significantly increased their capabilities and competitiveness in the construction of larger ships. As a consequence, there are now yards that are capable of building a wide range of commercial vessels, such as petroleum and product tankers, heavy freighters and multipurpose container ships. In addition the yards can produce other niche market vessels, such as fishing boats, research vessels, tugs, mega yachts, supply vessels and offshore boats.

7. The growth of the Turkish shipbuilding sector is evident in the rapid growth of the shipbuilding industry workforce, which grew from just 2 800 employees in 1998, to a peak of 33 500 in 2008 (see Chart 6). However, as elsewhere in the world, the recent global economic downturn significantly affected the industry in Turkey, and the workforce was estimated to have fallen to around 21 000 in mid-2010 (UMA, 2010). However, the growing output of those shipyards since 2007 also suggests that those shipbuilding facilities have also become significantly more efficient.

8. The specialization of the industry is also evident in recent production statistics. Turkish shipyards are considered to be highly ranked in the world in the production of small tonnage chemical/oil tankers (up to 10 thousand dwt), and this is certainly supported by the order book held by Turkish yards, which in January 2011 showed 62 orders for this class of vessel, second only to the 74 orders held by yards in China (Clarkson, 2011). Turkish yards are also quite highly regarded in the production of mega yachts.

9. In addition, Turkey’s support industries (that is, ship repair and conversion and the marine equipment manufacturers) contributed an estimated additional USD 1.5 billion to the Turkish economy in 2009, making the sector a significant component of the overall economy in its own right (UMA, 2011).

10. Domestic shipowners are strong supporters of the Turkish shipyards, and for a long time newbuilding output was largely directed at the domestic market. In some cases, shipowners own the yards and build vessels for their own fleets, as well as building vessels for other buyers.

11. This focus is understandable as the Turkish shipyards, in their early stages of development, specialize in the types of vessels, and the tonnage ranges, that most suit the freight tasks in the Mediterranean, Black, Marmara and Aegean seas. As a consequence, most of the clients of the Turkish shipyards are shipowners that operate in these areas, where Turkish and Russian flagged ships are strongly represented in the merchant shipping activities, and are ranked as first (16%) and second (13%) respectively. In particular, Turkish owned ships account for a 32% share of the associated shipping tasks.

12. While there may be some limitations with this model to penetrate the broader world market, the specialization of Turkish shipyards have gained considerable strength through it, as evidenced by Turkey’s growing expertise in the construction of small-medium chemical tankers, and the significant growth in the export of those types of vessels, especially since 2005.

SHIPBUILDING AND THE TURKISH ECONOMY

The Turkish economy

13. In parallel with experience around the world, the Turkish economy enjoyed an exceptional period of growth between 2002 and 2007. An abundance of liquidity in the Turkish financial system encouraged investments, which in turn drove significant economic growth in all sectors of the economy. However, the latter half of 2007 heralded a very significant and protracted global recession, from which the global economy is still emerging.

14. Turkey did not escape the effects of the global financial crisis, but the restructuring of the banking sector in 2001, and a significant decline in both the rate of public borrowing and in the budget deficit in the period leading up to the crisis, assisted Turkey to minimize its impact on its economy, and prevented financial problems from becoming unmanageably large.

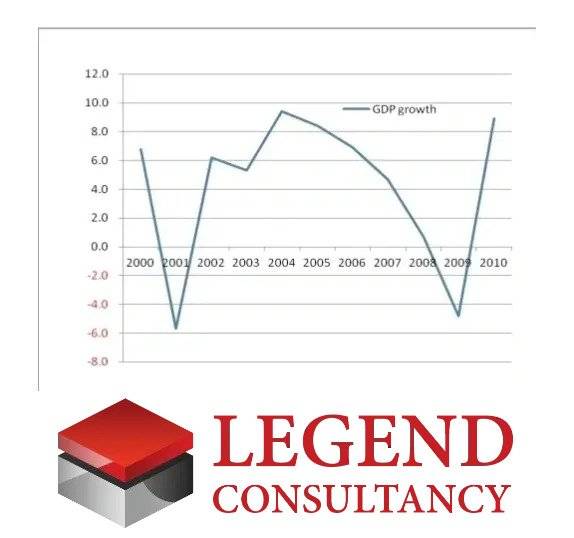

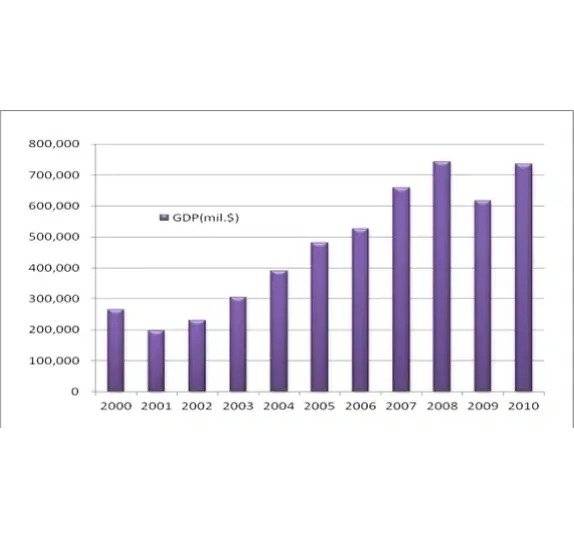

15. Despite this partial insulation from the effects of the global financial downturn, Turkey did not completely escape the effects of the recession, and its GDP dipped sharply in 2009 (see Charts 1 and 2), although preliminary data for 2010 shows a strong economic rebound. As elsewhere in the world, this decline in economic activity progressively affected investment, consumer demand, trade, shipping and ultimately shipbuilding, which although affected later than most industrial sectors because of the cascading effect, eventually experienced a very sharp decline in new orders.

16. The effects of the decline in shipbuilding activity are quite significant, as this is a sector that has been identified by the Turkish government as having the potential for considerable growth, and which makes a very significant contribution to the Turkish economy. According to figures from the Turkish Shipbuilders Association (GISBIR) in 2008 (latest available figures) the Turkish shipbuilding industry contributed around USD 2.7 billion to Turkish exports, while repair and maintenance operations added around USD 1.5 billion (UMA, 2011).

17. While this represents a relatively small proportion of the overall Turkish GDP, its importance should not be underestimated, because it represents the output of an industry sector that not only employs a large number of workers, but also contributes to the country’s industrial capacity and technological know-how. In addition, the growing export performance of the shipbuilding sector means that it also makes a significant contribution to Turkey’s balance of payments and foreign currency reserves

Chart 1 – Turkey GDP 2000-2010 (USD million)

Chart 2 – Turkey GDP growth (%) 2000-2010